Caixa Econômica Federal

Product Discovery, User Experience, User Interface

What is?

Caixa Econômica Federal (Caixa or CEF) is a prominent federal Brazilian bank headquartered in Brasília, the nation's capital. As the largest 100% government-owned financial institution in Latin America, it holds significant influence in the region. Founded on January 12, 1861, Caixa boasts a substantial revenue of USD 12.5 billion.

The project

The Working Time Guarantee Fund (Fundo de Garantia por Tempo de Serviço or FGTS in Portuguese) was established to safeguard workers dismissed without justification by creating an account linked to their employment contracts.

At the start of each month, employers deposit approximately 8% of each employee's salary into accounts opened at Caixa on their behalf. This fund comprises the total of these monthly deposits, and employees may access the amounts deposited in their names under certain conditions.

My role

I was appointed by Concrete to assist the FGTS Squad at Caixa in understanding customers' opinions, identifying solutions to their issues, and aiding in their implementation. My responsibilities included conducting client interviews, facilitating a Design Sprint, creating a product backlog, and introducing Continuous Interviewing as part of our Agile development process, operating under the SCRUM framework.

Business analysis

Caixa, though a prominent institution, had been slow to adapt to the digital landscape, with many services still primarily offered in-person at branches. A business analysis conducted by the Boston Consulting Group (BCG) highlighted this issue, prompting Concrete's involvement in developing digital solutions. While the analysis raised concerns, it failed to address crucial questions regarding customer wait times and frequency of visits to branches. Our goal was to determine if these issues could be resolved through digital means and, if so, how.

40 min

Avg time spent at agency

R$6,00

Avg cost of having that customer at the agency

Talking to users

To gain insight into customer experiences, we initially reviewed online store feedback to understand users' perspectives.

Google Play review

App Store review

Subsequently, we visited branches with high customer traffic to conduct interviews. These interactions provided invaluable insights into the pain points experienced by users and their overall satisfaction with Caixa's services.

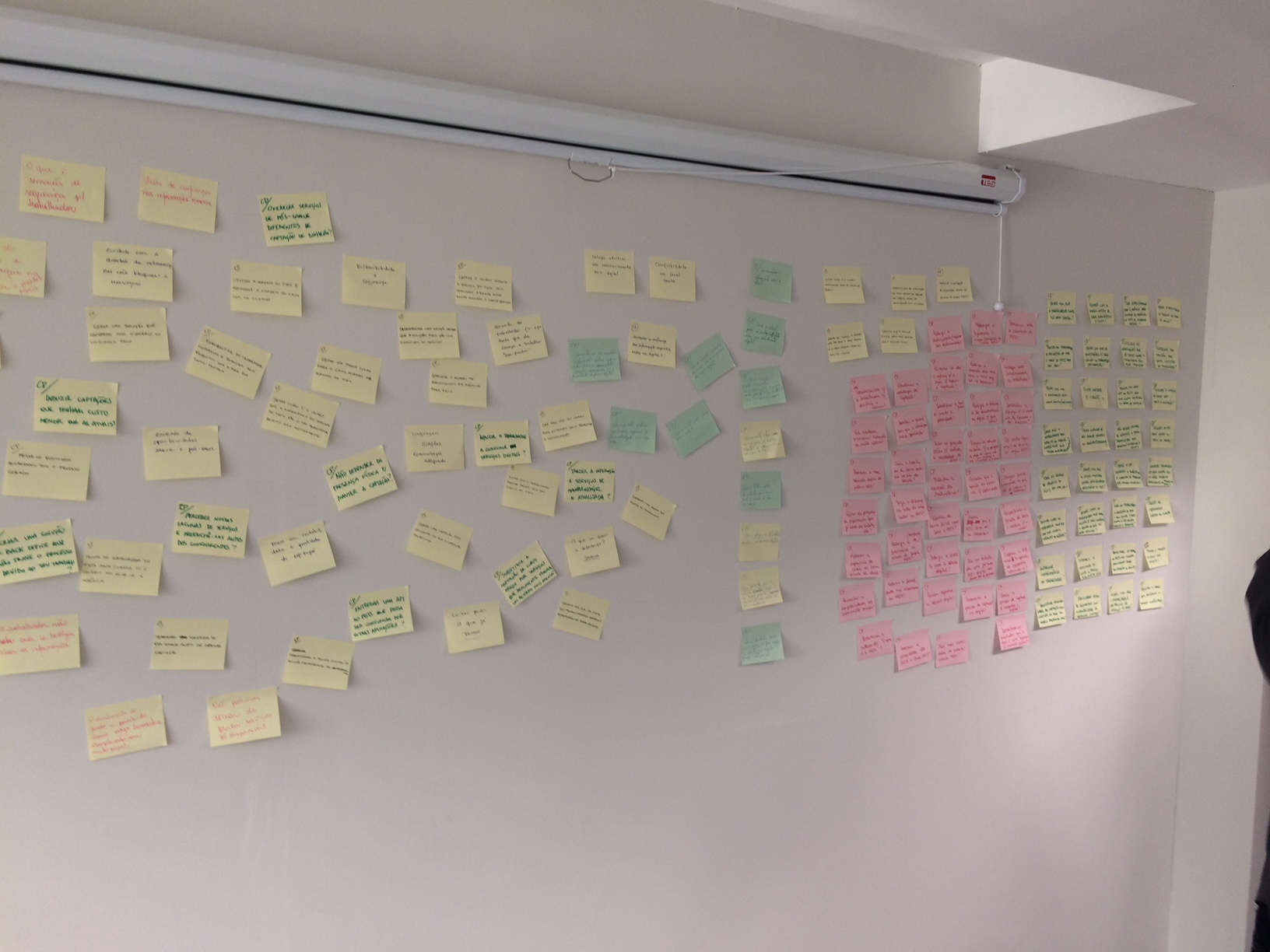

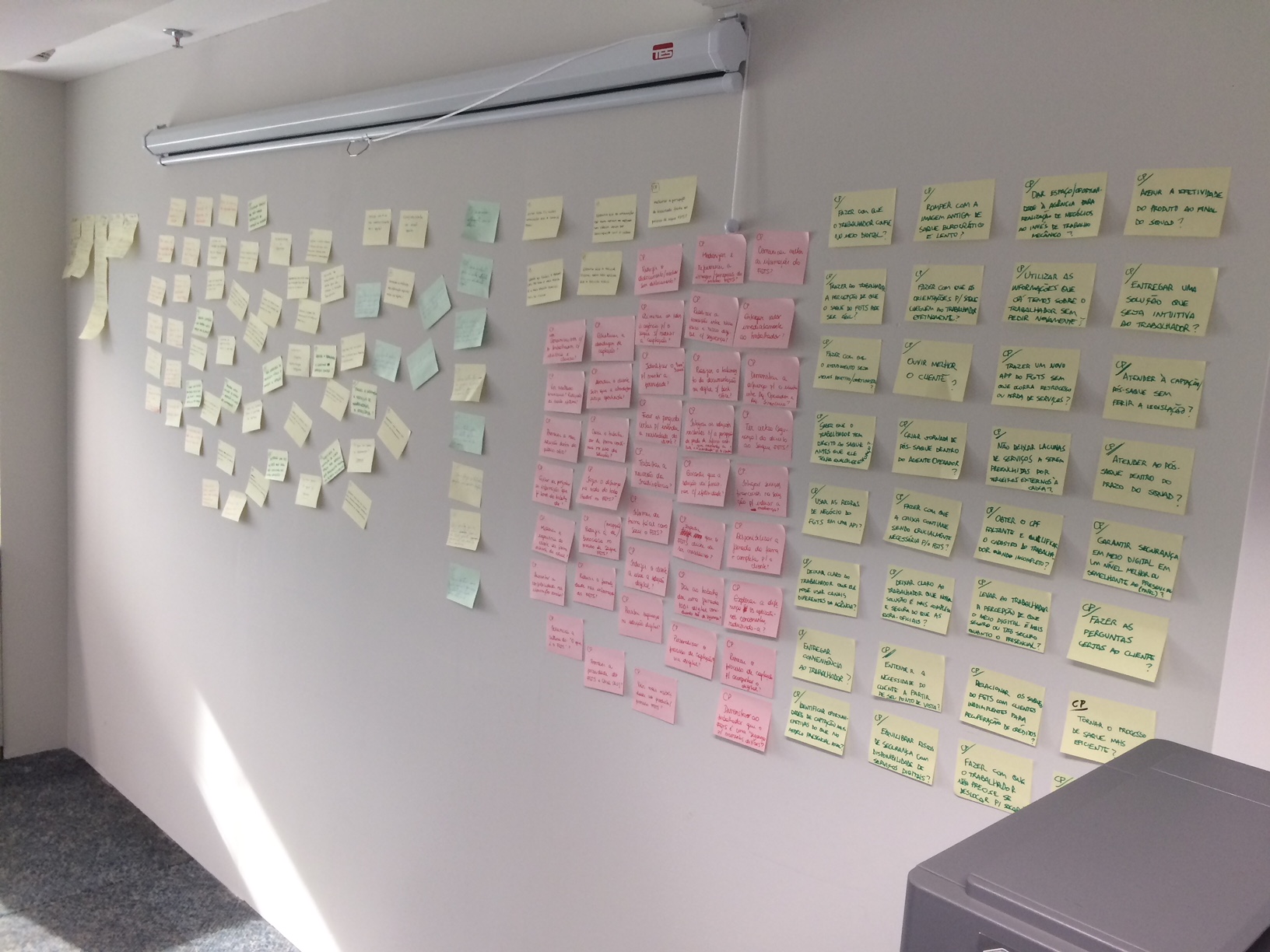

Our interviews yielded numerous insights, with particular emphasis on addressing issues identified by both customers and bank personnel. To minimize profit loss and enhance user satisfaction, our digital solution aimed to:

Reduce branch visits and associated costs by enabling digital withdrawal of funds.

Provide digital assistance for common queries, reducing the need for in-person visits.

Increase revenue through the promotion of Caixa bank accounts and additional financial products/services such as real estate financing and investments.

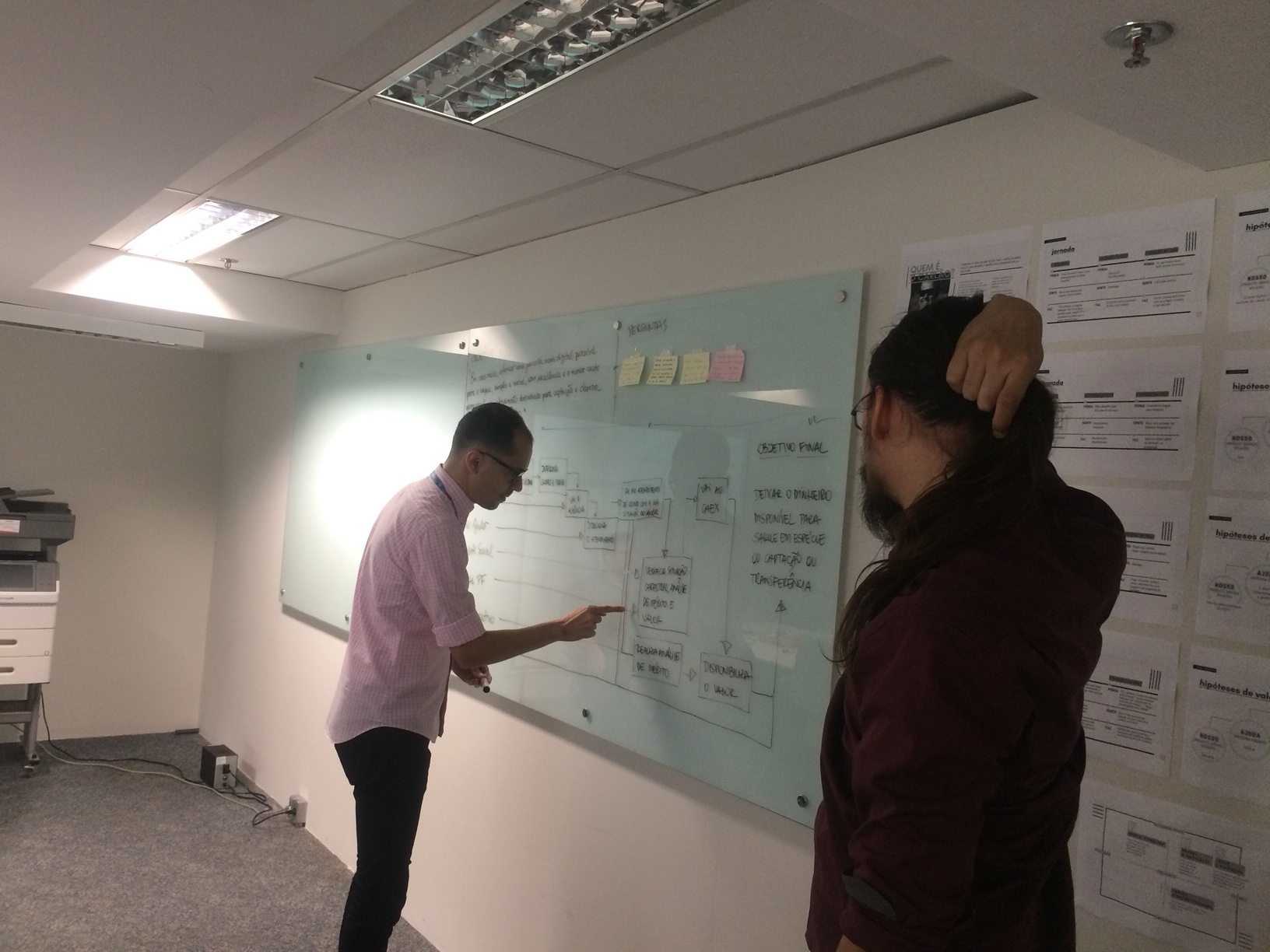

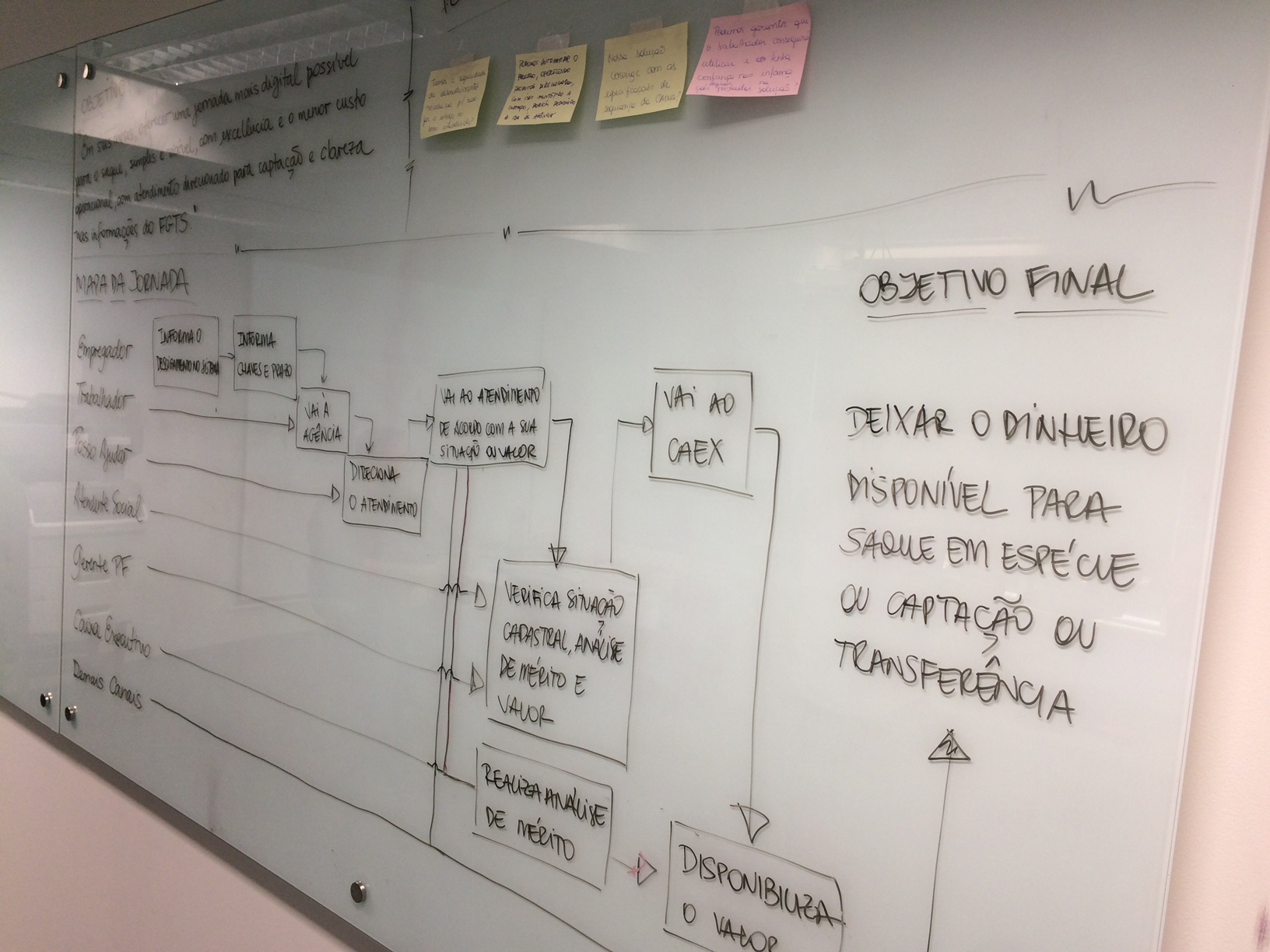

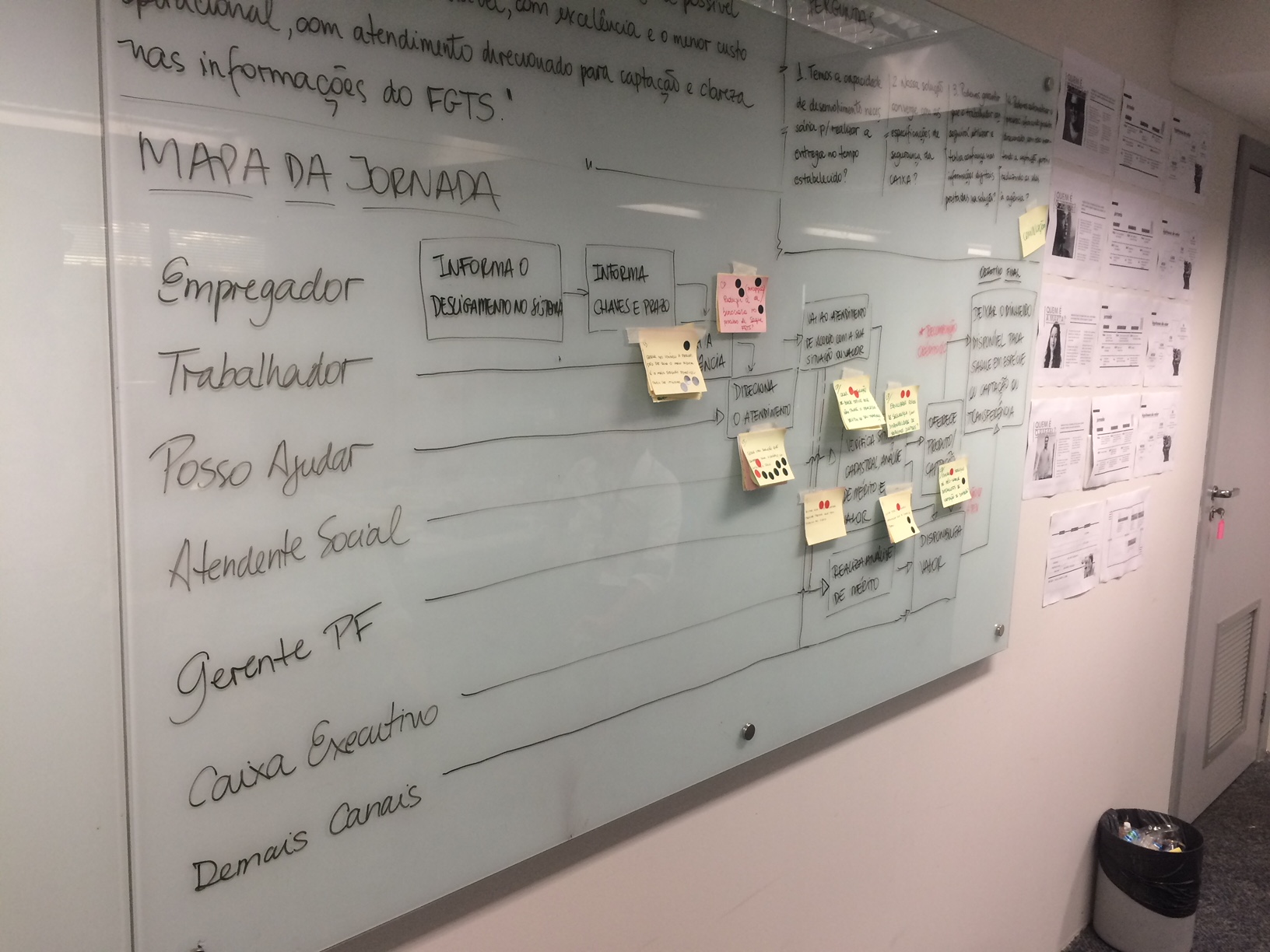

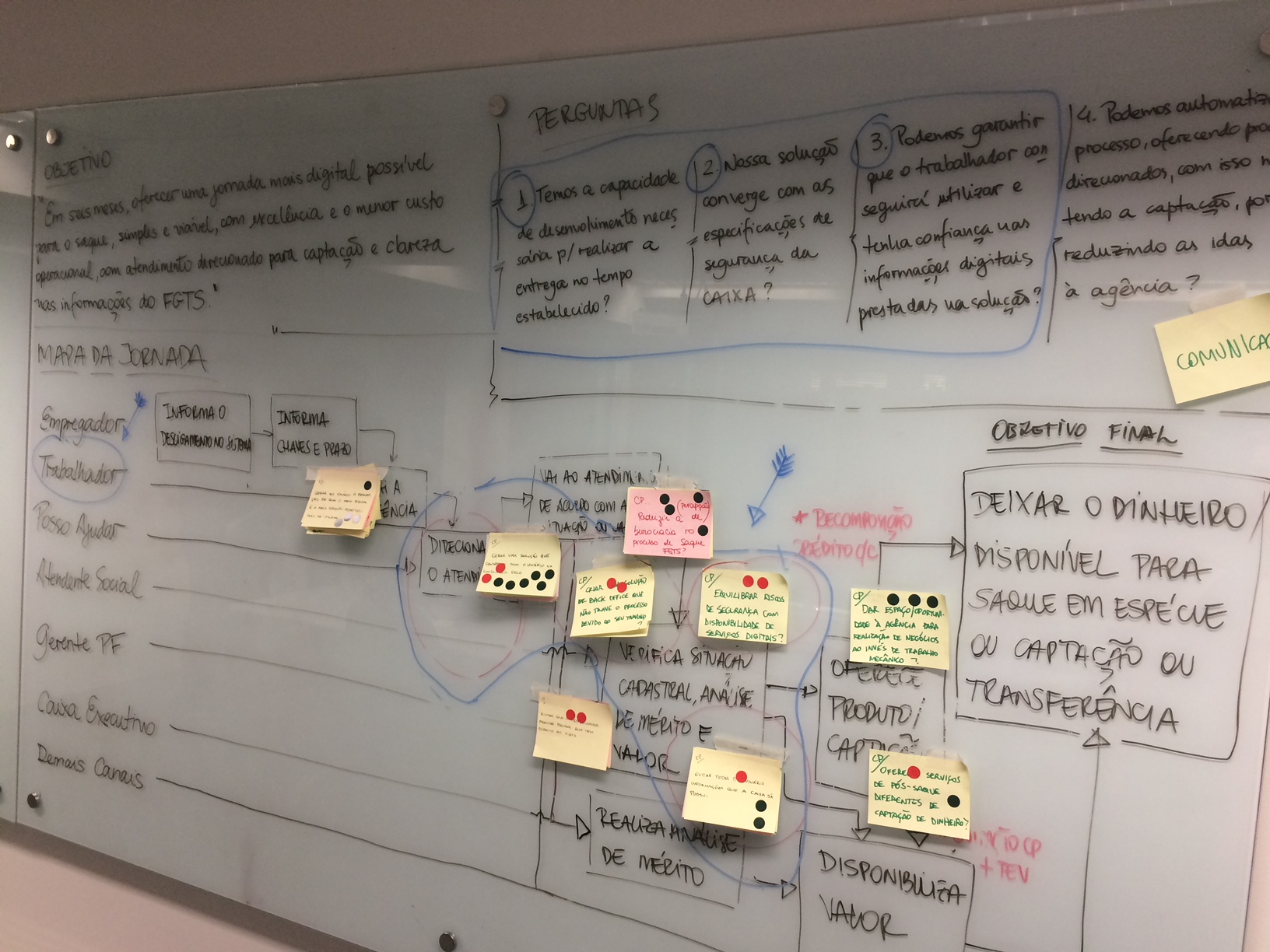

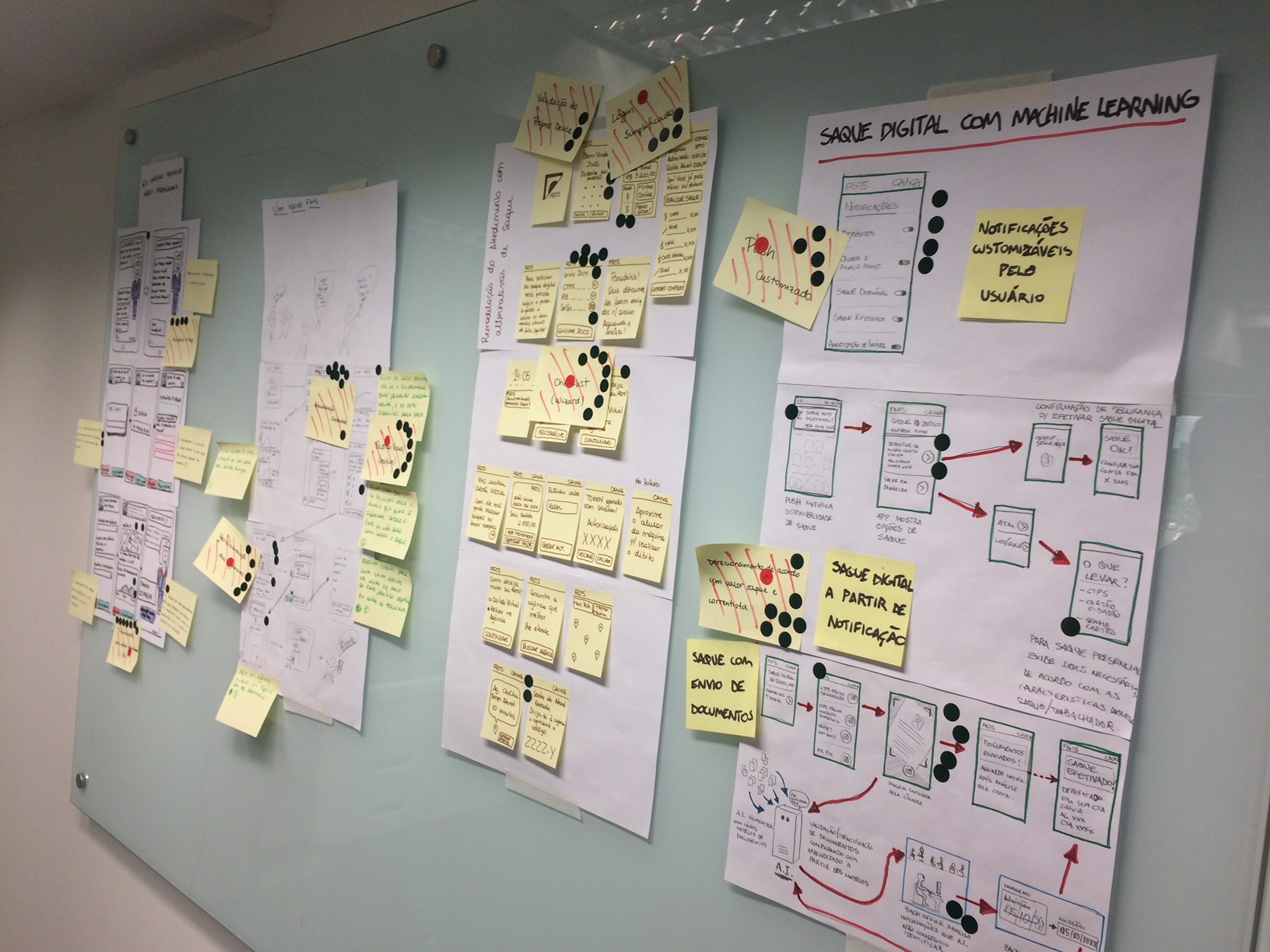

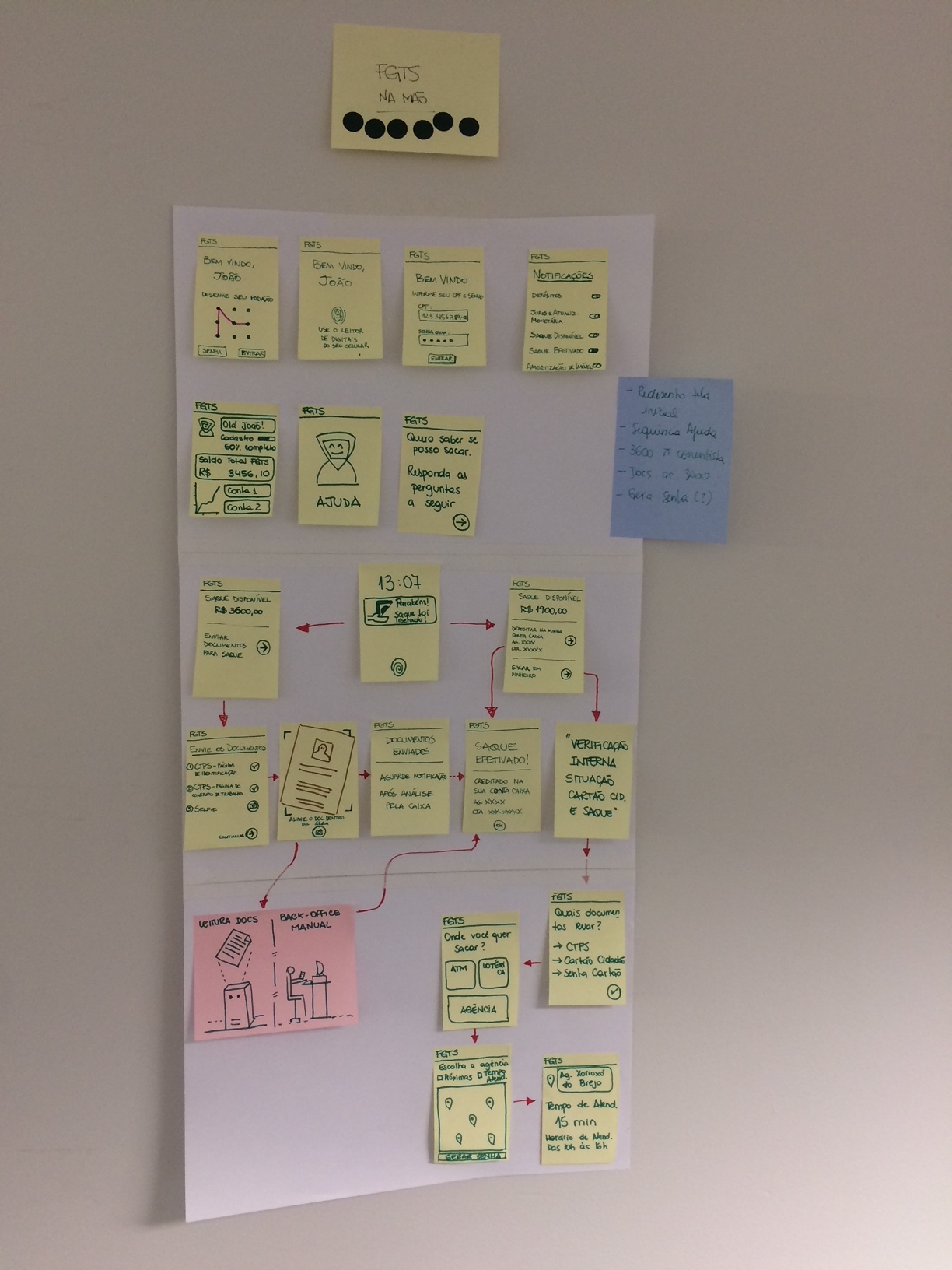

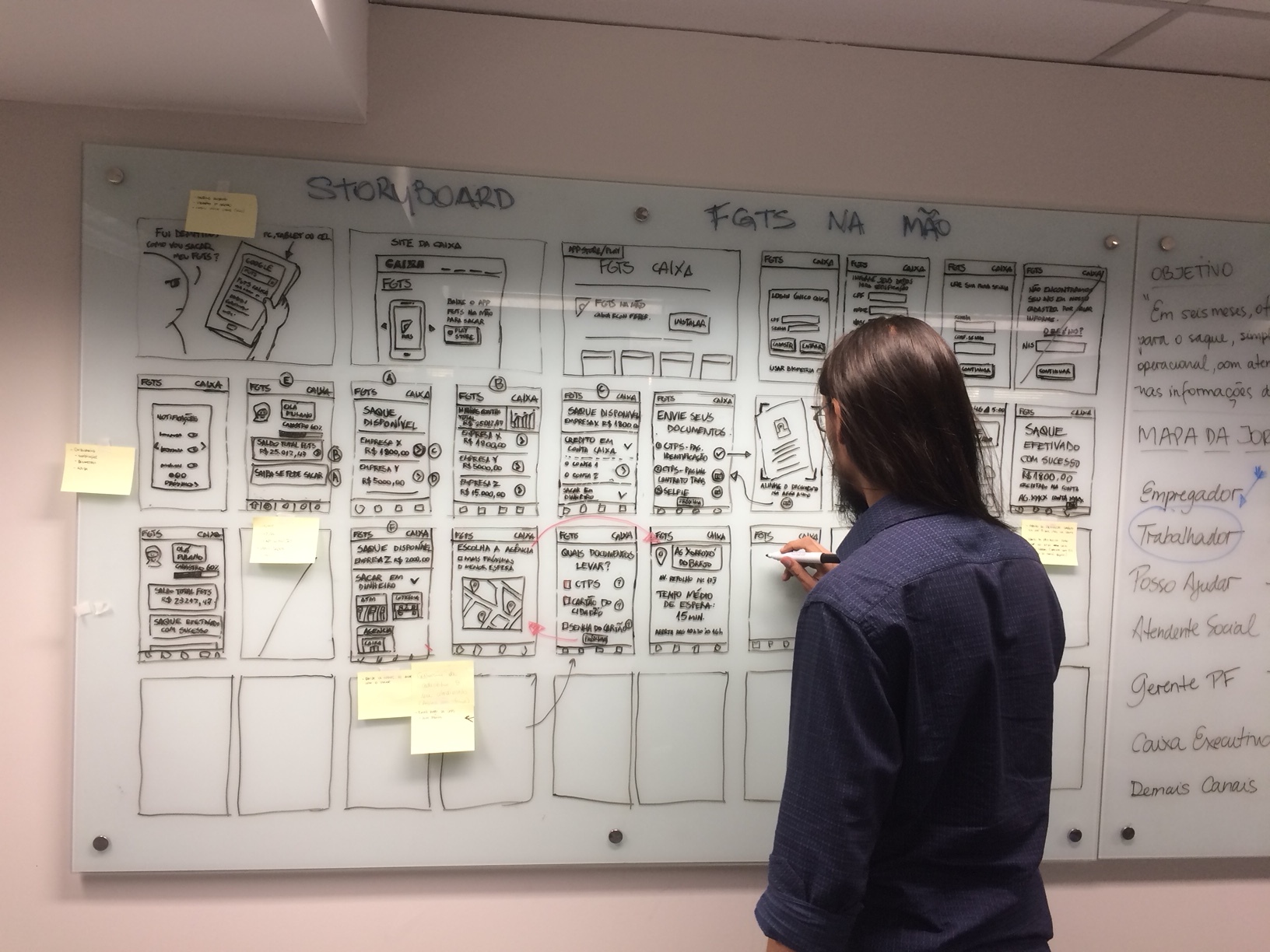

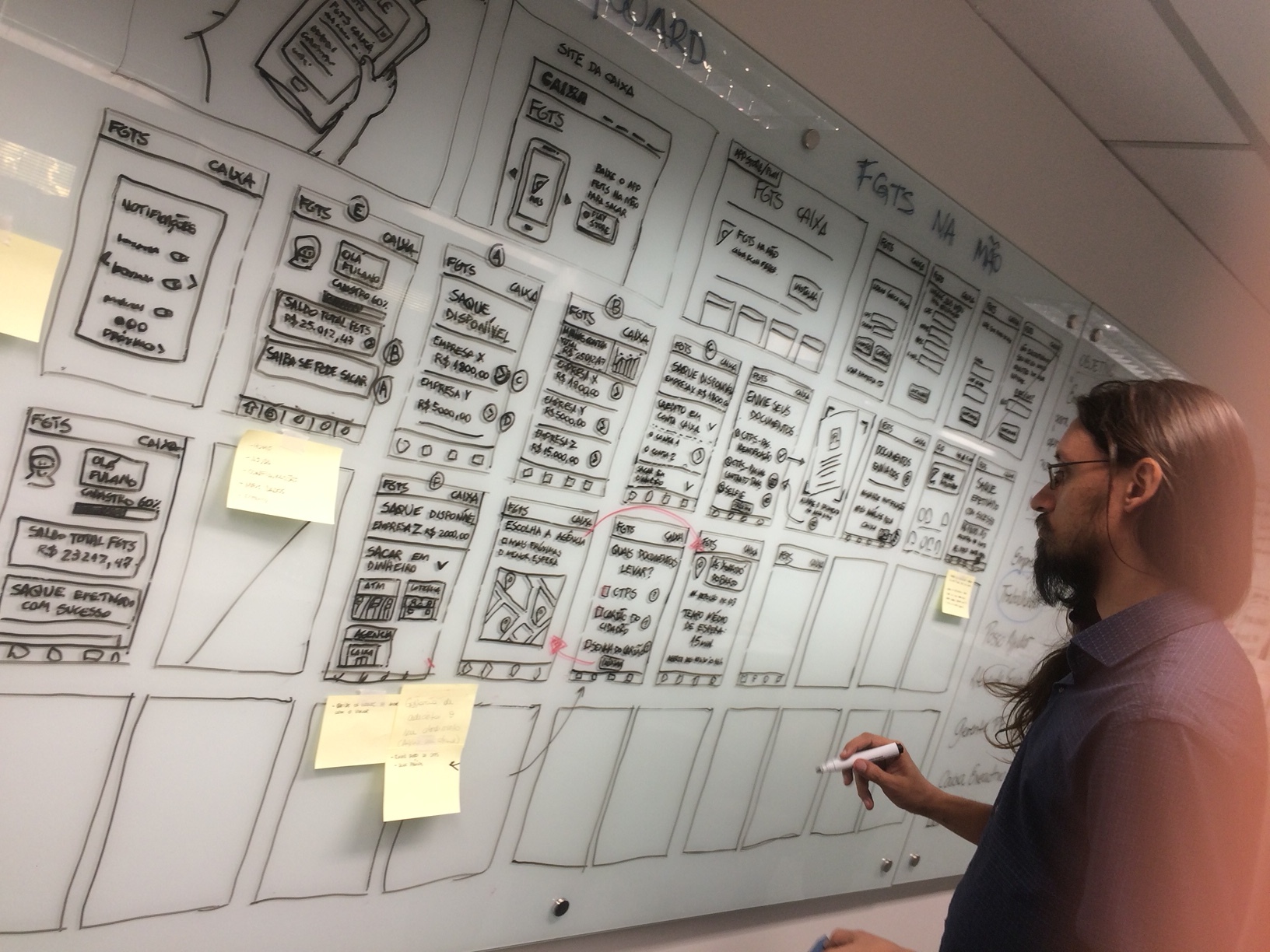

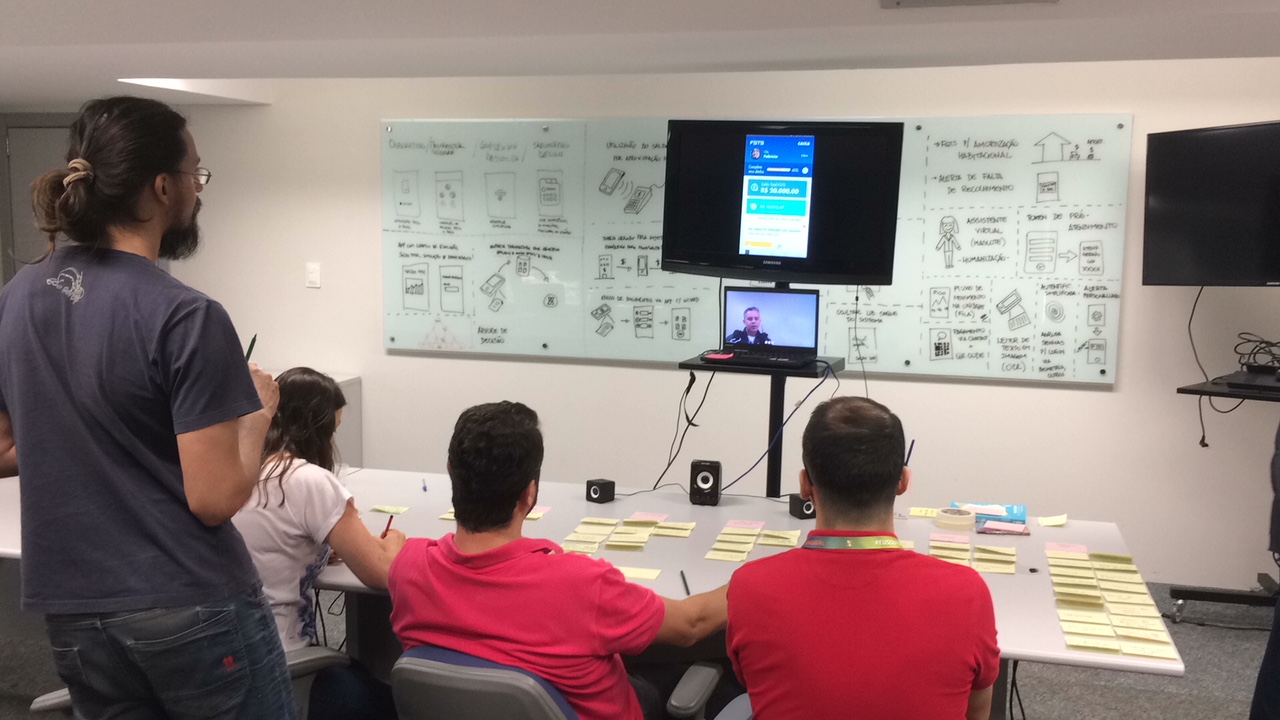

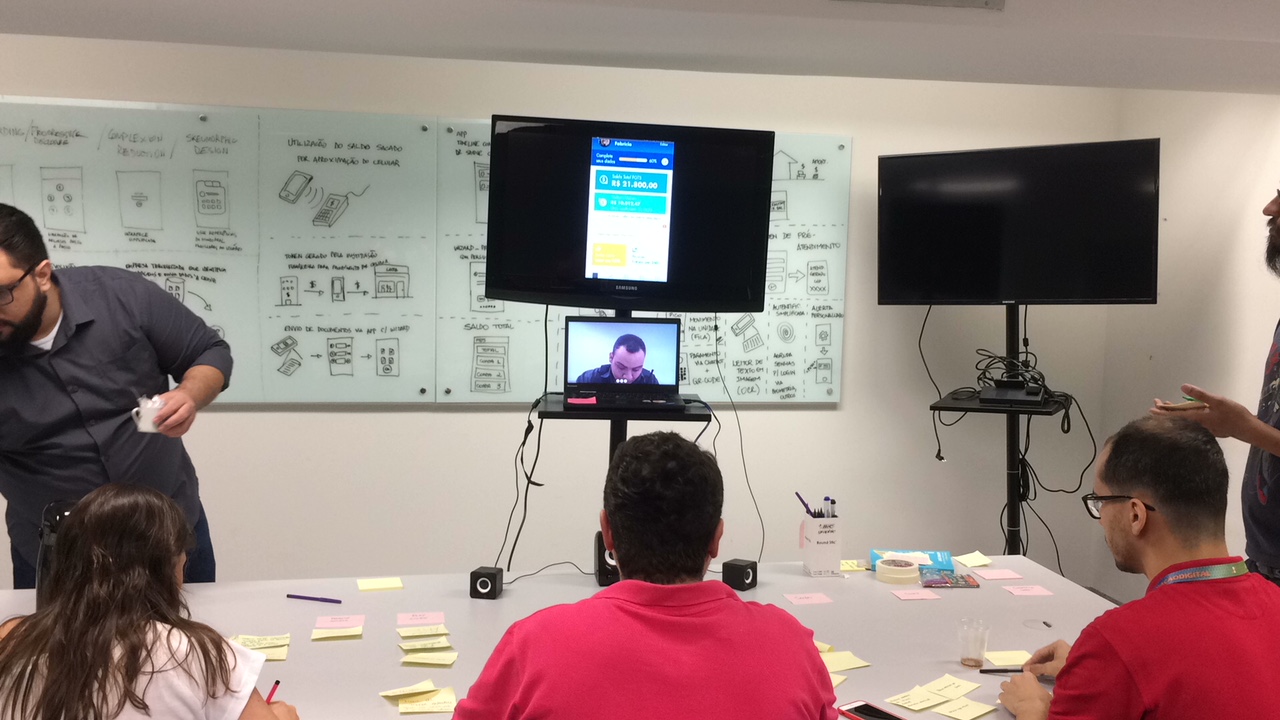

The Design Sprint

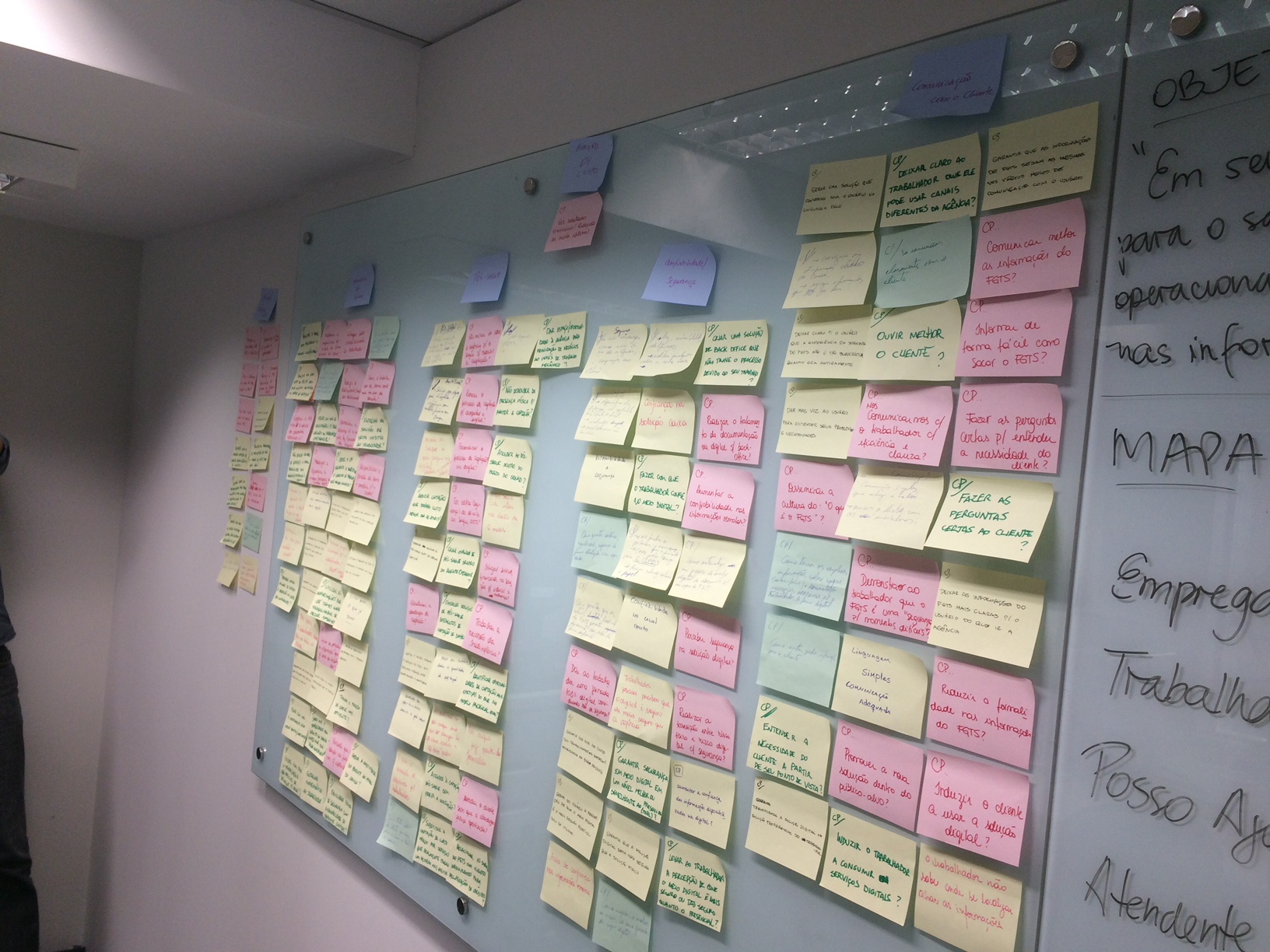

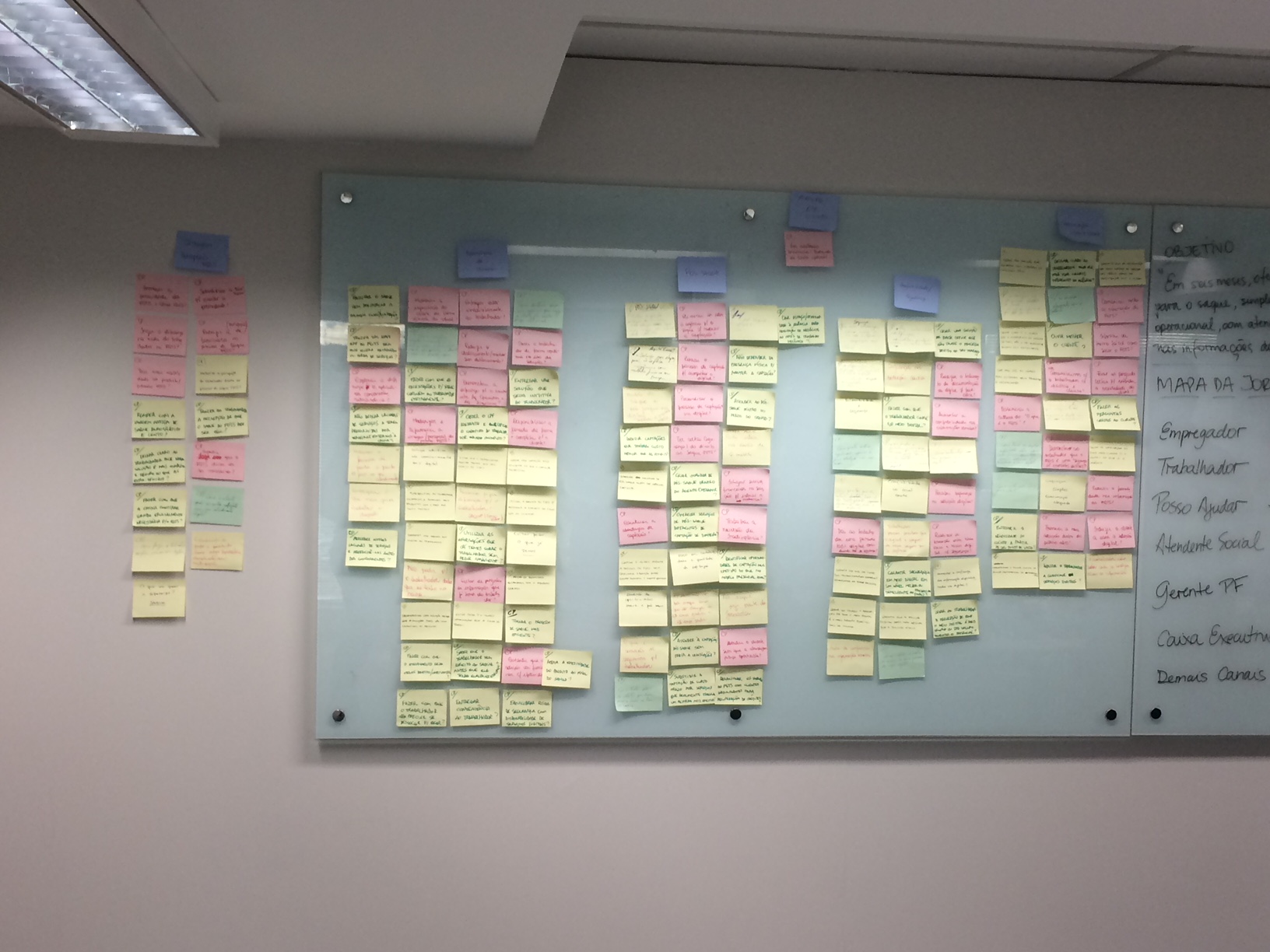

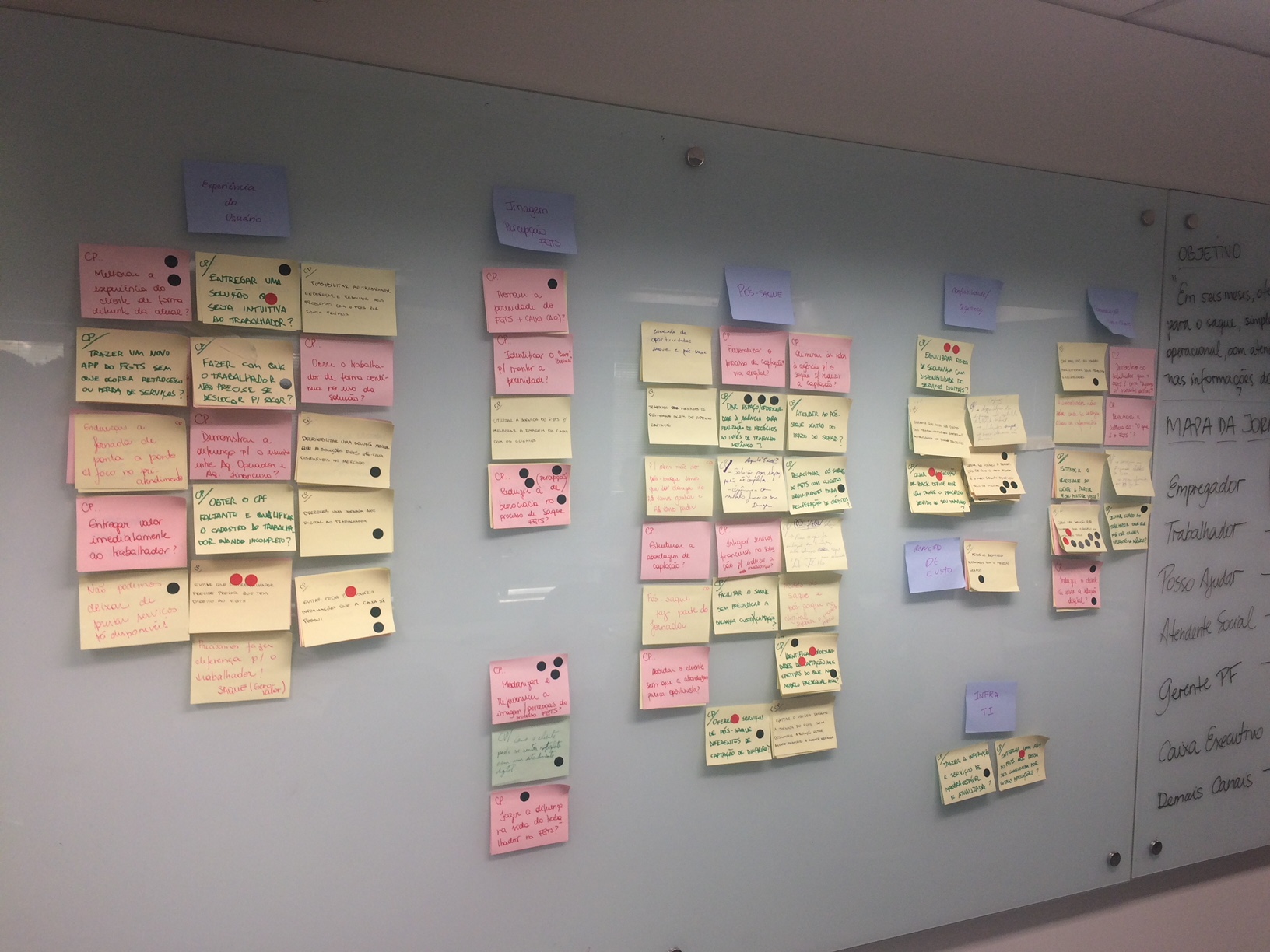

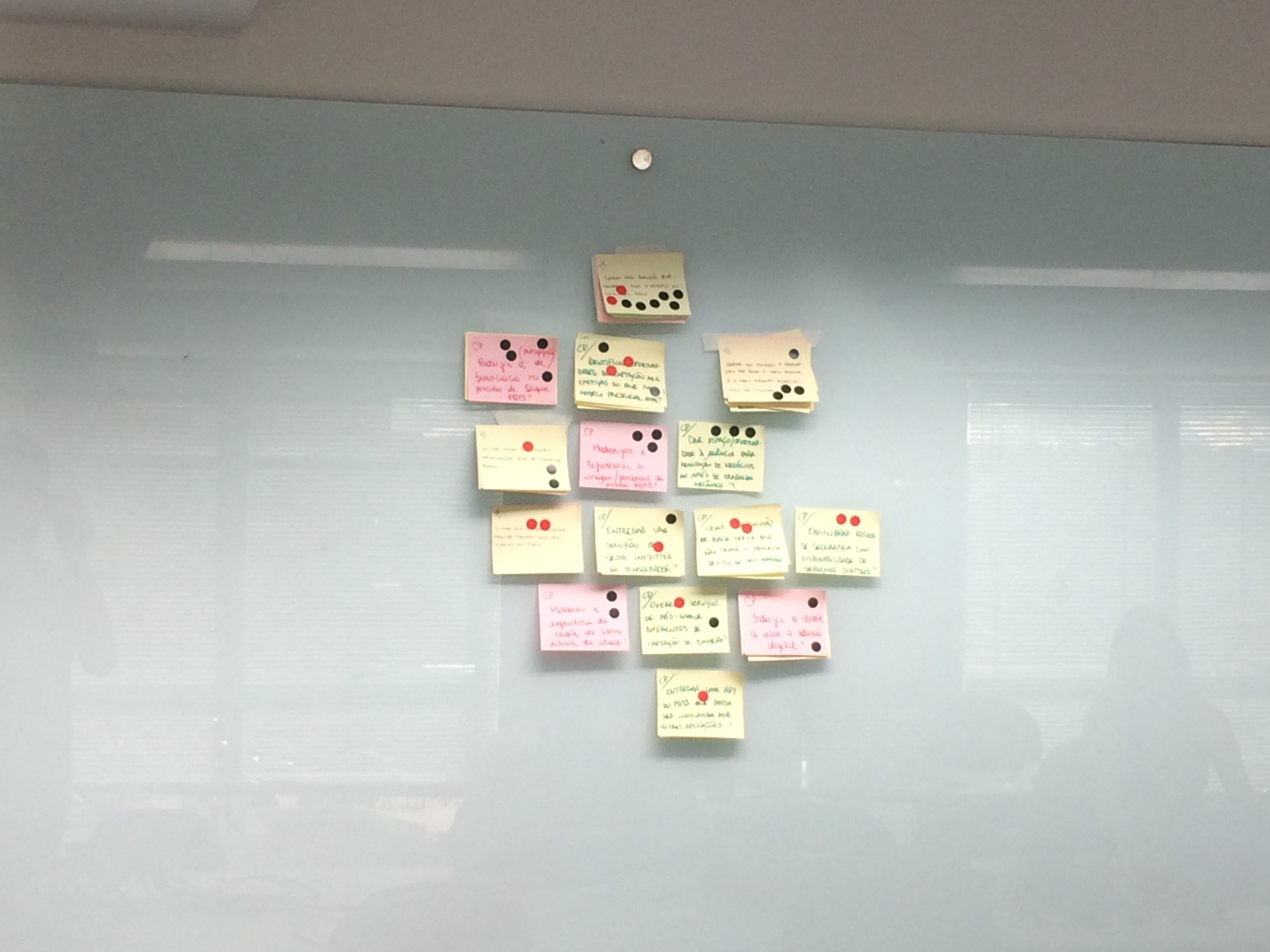

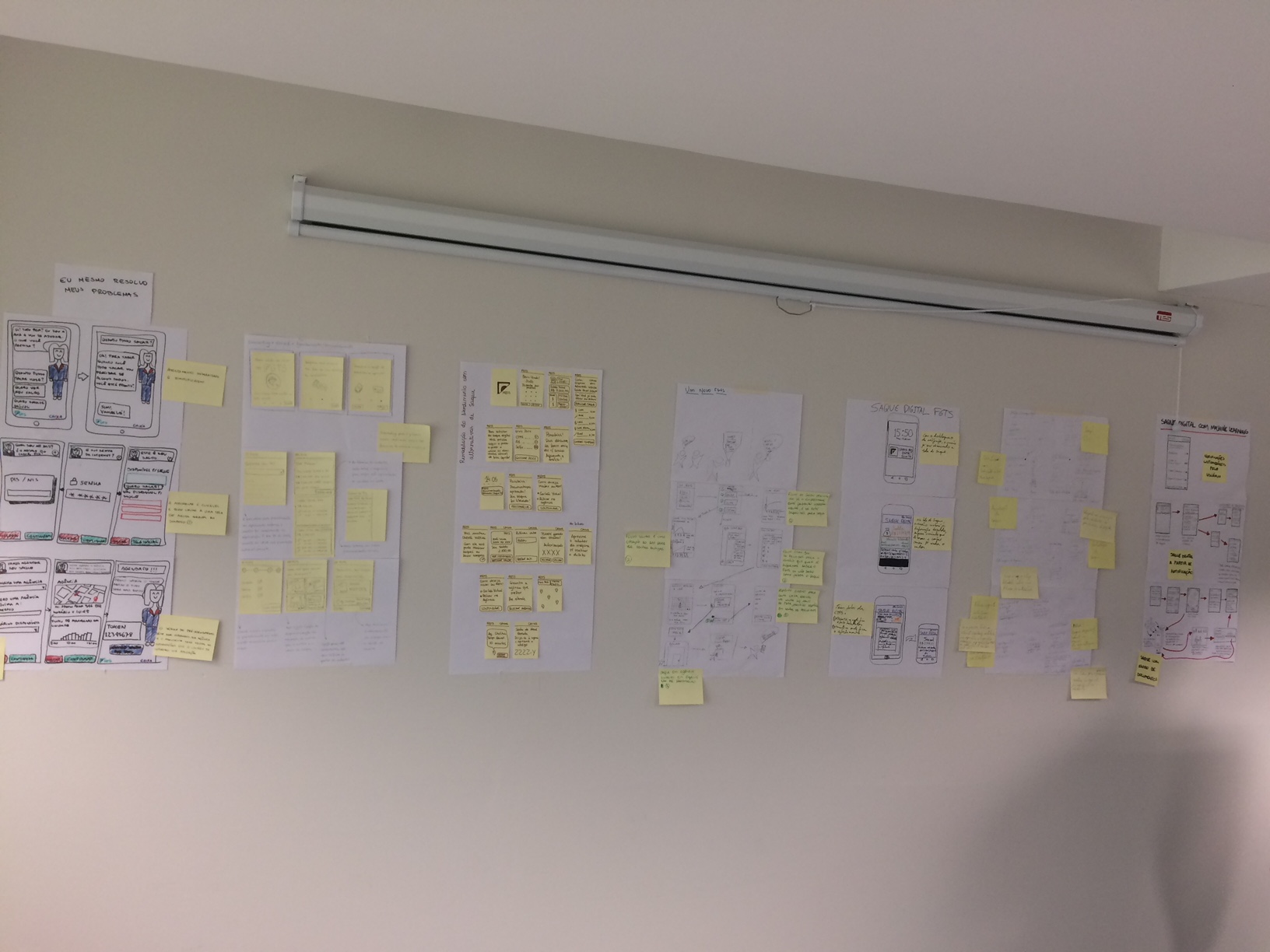

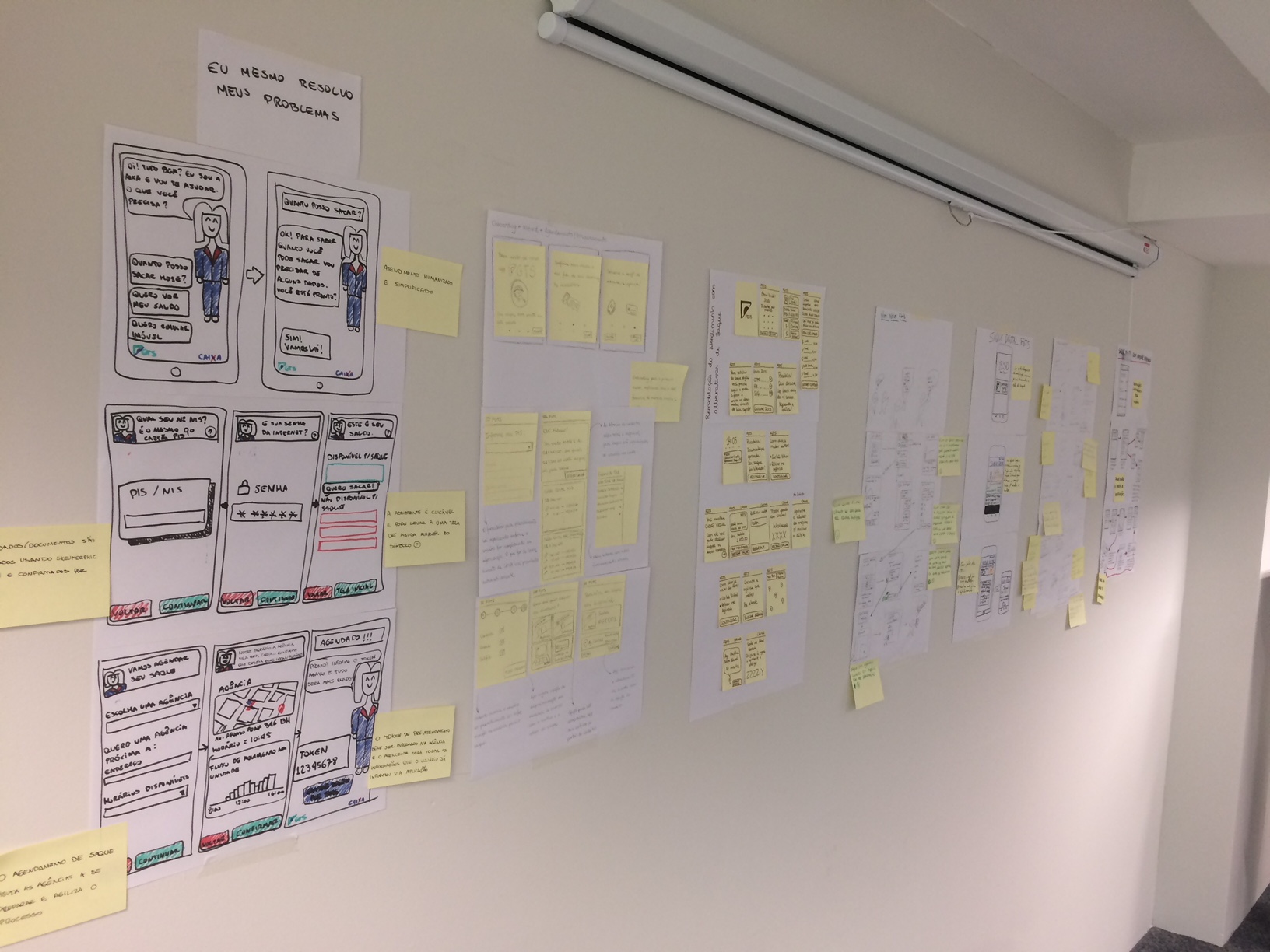

Given the vast scope of the FGTS product, which caters to approximately 33 million Brazilian employees, we chose to focus on select user segments for prototype development. To inform our design process, we conducted a 5-day sprint involving developers, stakeholders, branch personnel, and legacy software experts.

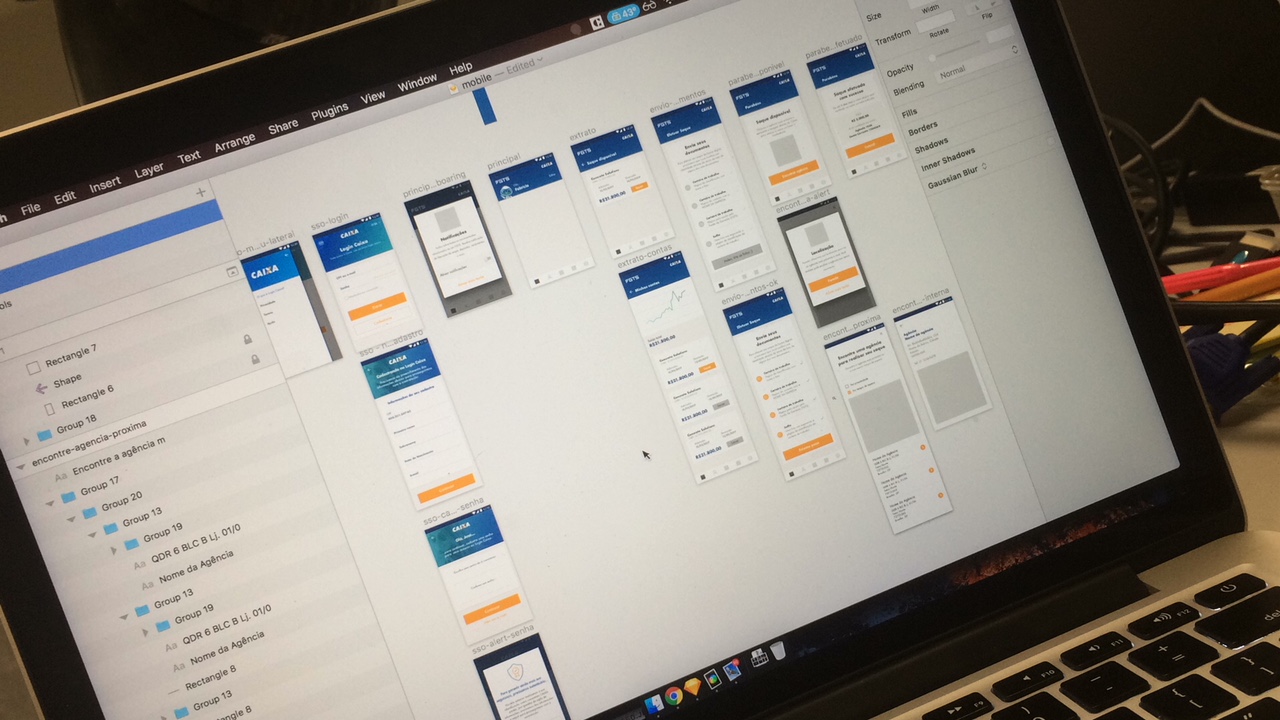

Continuous Interviewing

Introducing Continuous Interviewing allowed Caixa to continuously gather user feedback and validate ideas before development. High-fidelity prototypes were created using Marvel, enabling us to collect feedback iteratively during the sprint cycles. Our product was initially deployed to 1% of users (~300,000) to gauge acceptance and collect data on the new interface's performance.